Dear Clients,

This is to remind you that Singapore companies are required to lodge statutory filings as required by the Singapore Companies Act with ACRA.

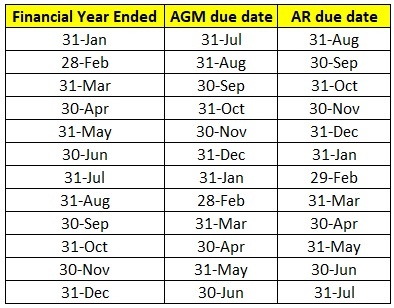

Singapore companies are due to hold its Annual General Meeting (AGM) within six (6) months from the preceding financial year and to file AR (within one month after the date of AGM).

Do note that Singapore private companies may be exempt from holding AGMs subject to certain requirements.

For further information as to whether your Singapore companies are eligible for the exemption, please contact our corporate secretarial team for advice.

Statutory Requirements

1. Hold the AGM – as required under Section 175 of the Singapore Companies Act unless exempted.

2. Present a full set of SFRS financial statements – as required under Section 201 of the Singapore Companies Act, if applicable.

3. File Annual Return (AR) after AGM – as required under Section 197 of the Singapore Companies Act.

Extension of time to hold the AGM and to file Annual Return (AR)

If you are unable to comply with the timelines stipulated under section 175 and/or section 197 of the Singapore Companies Act, we can assist to apply for an extension of time to ACRA to hold the AGM or file AR.

For more information on the extension of time, our company secretary team can provide the necessary assistance.

Dormant Singapore company

If the company is not in operation and there is no intention to carry on business, you may consider applying to strike off the Singapore company.

For more information, our team can explain the matters to take note of and procedures to strike off the Singapore company.

Debarment of Directors or Company Secretary

Please note that a director or company secretary who fails to comply with statutory filing requirements as set out in the Singapore Companies Act for a continuous period of 3 months or more, may face a debarment order from the Registrar preventing the director or company secretary from taking on any new appointments as director or company secretary of any company (section 155B Singapore Companies Act).

Should you need assistance on business outsourcing, please send an email to Contact@AccountingSolutionsSingapore.com, and our business advisor will contact you.