Tax exemption schemes in Singapore

In the Year of Assessment (YA) 2005, the Government introduced the Start-Up Tax Exemption (“SUTE”) scheme to support entrepreneurship and to foster the growth of local enterprises.

In the Budget 2018, the Government revised the SUTE to strengthen other support for businesses to build capabilities. For companies that qualify under the scheme, the changes will take effect from YA2020.

In accordance with the changes, eligible companies will receive the following tax exemption for their first three consecutive YAs:

From YA 2020 onwards

Start-up businesses eligible for SUTE enjoy a 75% tax exemption on the initial SGD 100,000 chargeable income and a further 50% tax exemption on the next SGD 100,000.

Up to YA2019

Start-up businesses eligible for SUTE enjoy a 100% tax exemption on the initial SGD 100,000 chargeable income and a further 50% tax exemption on the next SGD 200,000.

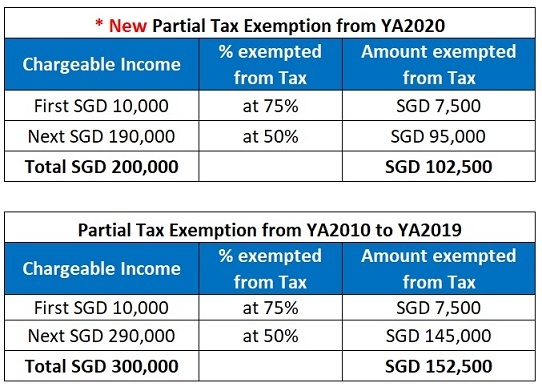

The SUTE scheme is for the first three consecutive tax years of operating a business in Singapore. From the fourth tax year onwards, the company is eligible to enjoy the Partial Tax Exemption (PTE).

What are the exceptions to the SUTE scheme?

This tax exemption scheme is all companies that are incorporated in Singapore except for:

1. The start-up whose main objective is developing properties for investment, sale, or both.

2. The start-up entity’s principal activity is that of investment holding.

In real estate, a new company is set up for each new property development, while an investment holding company earns passive incomes i.e. interest and dividends.

This tax exemption scheme is to encourage entrepreneurship and does not apply to the above companies. However, they can enjoy the Partial Tax Exemption (PTE) Scheme.

What are the Qualifying Conditions for SUTE scheme?

Eligible companies must comply with all the following qualifying conditions:

1. The start-up companies must be a tax resident for a particular Year of Assessment (YA);

2. The start-up companies must be a Singapore incorporated entity;

3. No more than 20 shareholders are beneficially holding the company’s total equity capital throughout its basis period, during which:

(i) The shareholders are all individuals; or

(ii) The company has at least one individual shareholder who owns 10% of the company’s issued ordinary shares.

How to determine the first YA of the Company?

Companies are eligible for exemptions for their first three consecutive YAs. The first YA refers to the basis period in the year of incorporation of the company. Basis period refers to the 12 months period immediately preceding the YA.

A company’s first tax year may vary depending on when its first financial year ended when the company closed its first set of accounts. Therefore, the first tax year of one company may differ from another company incorporated on the same day. Companies should determine the appropriate financial year end to enjoy the exemptions for the first three consecutive YAs.

What differentiates a “Tax-Resident” and a “Non-Tax Resident” Company?

A company in Singapore is either a non-tax resident or a tax resident. The tax residency of a business depends on where it is managed and controlled. This tax resident status can change from one year to the next.

A company is a tax resident if they exercise management and control in Singapore. The reference to “management and control” relates to decisions making issues, such as those concerning strategies and policies.

Where this action takes place is a question of fact.

In Singapore, if the Board of Directors meets to discuss strategic issues, then this is the location where the management exercises its control. However, if the management and control take place outside of Singapore, the company will assume a non-resident status.

Also, it is worth noting the company’s place of incorporation is not the sole reason to decide their tax residence. Singapore branches of foreign companies and non-Singapore incorporated companies are managed and controlled by a parent company based overseas, and therefore they are non-residents.

Get Singapore Company Tax Assistance Today!

We provide a full range of professional accounting and tax compliance services to Singapore companies and new start-up companies.

Do you need help with this matter? Reach out to our Corporate tax team for more information today. We will provide assistance to help you understand the Singapore tax regulatory requirements and file tax returns on time.

2 Responses

Hi

I have make some purchases from Alibaba less then $500 items for personal usage do I need to tax exemption.

Hi Jasper,

We have received your message and our team will reach out to you shortly.

Thank you.

Best regards,

Kristy Wong

Client Manager